According to CBP, exam topics typically include: Entry; Classification; Trade Agreements; Valuation; Broker Compliance; Power of Attorney; Marking; Drawback; Bonds; Foreign Trade Zones; Warehouse Entries; Intellectual Property Rights; and other subjects pertinent to a broker’s duties.

Further, the Customs Broker License Examination is a four and half hour long, open book test, consisting of 80 multiple-choice questions based on designated editions of:

- The Harmonized Tariff Schedule of the United States (HTSUS)

- Title 19, Code of Federal Regulations

- Specified Customs Directives

- Customs and Trade Automated Interface Requirements document (CATAIR)

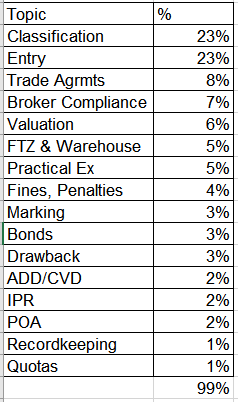

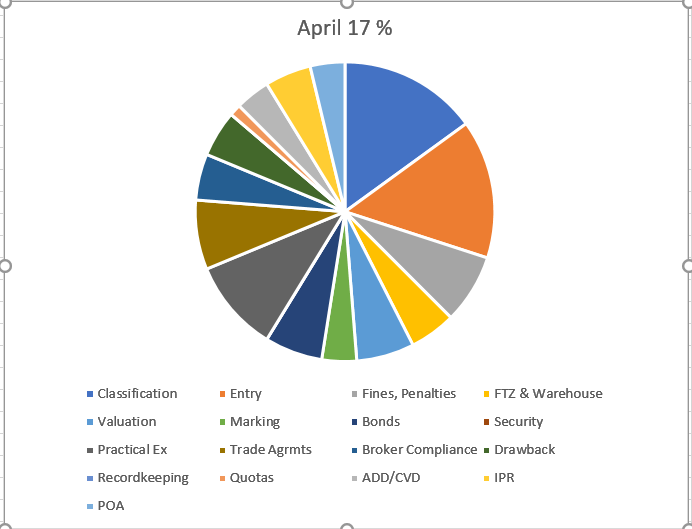

We have reviewed all the questions set in the past 20 exams over the last 10 years (from April 2008 to April 2017) and identified the 16 tested topics with relative percentage of questions asked from each topic. This information is arranged in descending order of importance in the table below:

The statistics clearly show that Classification and Entry were the most heavily tested topics comprising nearly half the questions set in the test. Trade Agreements, Broker Compliance and Valuation topics were the second set of important topics. FTZ & Warehousing, Practical Exercises, Fines and Penalties were ranked third in terms of importance. Marking, Bonds and Drawback was the fourth set followed by ADD/CVD, IPR and POA forming the fifth set. Finally, Record keeping and Quotas were the last two minor topics. These 16 topics accounted for 99% of the questions set in the exam.

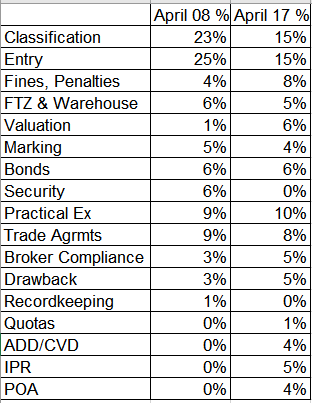

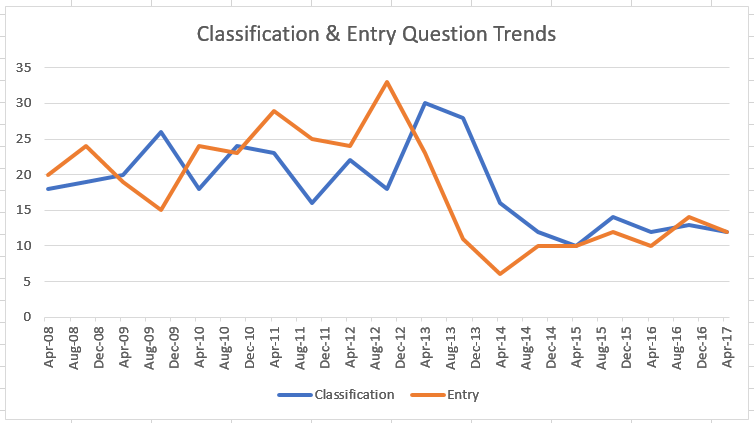

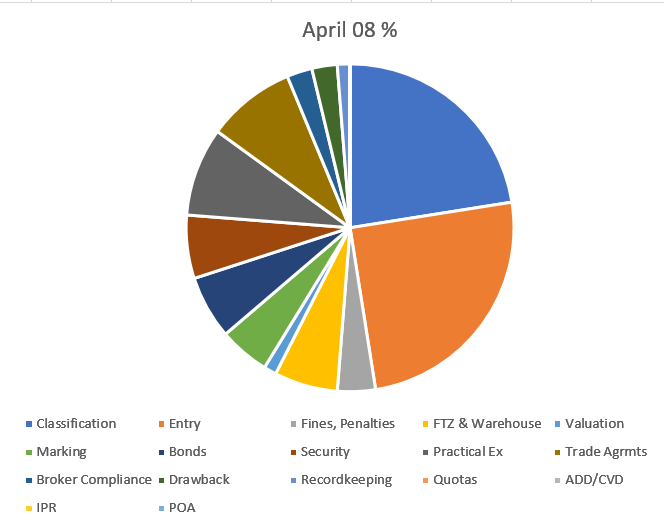

We also looked at the trends in terms of variation in percentages of questions from tested areas over the period from April 2008 to April 2017 and determined that the question pattern had undergone some changes as follows:

Entry and classification questions are still heavily tested but the emphasis on those topics has reduced slightly to accommodate more topics since 2013. As a result, a few more questions are now included from topics such as Valuation, Anti-dumping/countervailing duty, Fines & Penalties, Intellectual Property Rights and Power of Attorney.

Contact Information

For more information about this blog post, please send us a message using our Contact Us form or call (919) 923 4280.

Leave A Comment

You must be logged in to post a comment.